Call us at (855) 458-1985

Top Broker, Best Coverage

Secure Your Loved Ones’ Future with Ease

Compare rates from dozens of providers

Near-perfect customer ratings

Benefits of Final Expense Life Insurance

Affordable

Manageable premiums cover end-of-life expenses without burdening loved ones.

Simple process

No medical exams and minimal paperwork for quick and stress-free coverage.

Guaranteed

Certain policies offer protection regardless of potential health problems.

How does it work?

Get a Free Quote

Answer a few simple questions to calculate your rates from top insurers, keeping the process simple and efficient.

Compare Pricing

Buy a Policy

Rated “Excellent” on Google

Ready to see pricing?

Frequently asked questions

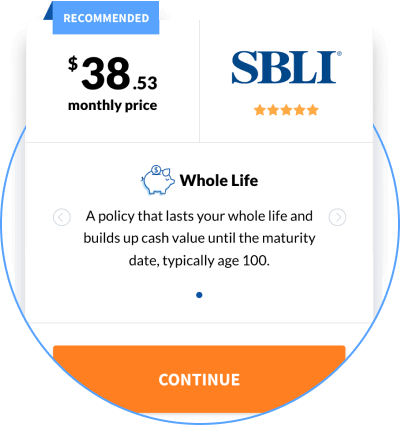

Final expense insurance is a whole life insurance policy designed to cover your final expenses, such as funeral costs, medical bills, and outstanding debts. It typically comes in smaller coverage amounts (usually between $2,500 and $50,000) and is easier to qualify for than traditional life insurance. It may be a good option if you want to ease the financial burden on your loved ones, don’t have much life insurance, are concerned about funeral costs, or prefer a policy without a medical exam.

- Level Benefit: Full coverage from day one, requires good health.

- Graded Benefit: Pays a percentage of the death benefit in the first few years, increasing over time.

- Modified Benefit: Similar to graded but with a longer waiting period.

- Guaranteed Acceptance: No health questions, with a waiting period before full benefits are paid.

- Funeral Insurance: Purchased from a funeral home to cover funeral services.

- Group Life Insurance: Offered through employers or organizations with possibly lower premiums.

Applying is simple. You can get a free quote online or by phone with an Insurancy agent. Most policies are “simplified issue,” meaning no medical exam is required.

Yes, different policy types cater to various health conditions. For instance, guaranteed acceptance policies do not require health questions.

Approval is typically quick, with applications being short and many insurers offering near-immediate approval.

Yes, premiums for final expense insurance policies are generally fixed and will not increase over time.

Beneficiaries can use the death benefit for any purpose, such as funeral expenses, medical bills, or other debts, providing financial flexibility during a difficult time.

- Coverage Amount: Estimate your final expenses and any outstanding debts.

- Policy Type: Choose based on your health situation and budget.

- Premium Cost: Compare quotes from different insurers.

- Financial Rating: Ensure the company you choose is financially stable.